Summitpath Llp - The Facts

Summitpath Llp - The Facts

Blog Article

Rumored Buzz on Summitpath Llp

Table of Contents9 Simple Techniques For Summitpath LlpGet This Report on Summitpath Llp10 Easy Facts About Summitpath Llp DescribedSome Known Details About Summitpath Llp

Most lately, launched the CAS 2.0 Practice Development Coaching Program. https://sandbox.zenodo.org/records/279389. The multi-step mentoring program includes: Pre-coaching placement Interactive team sessions Roundtable conversations Embellished coaching Action-oriented mini plans Firms aiming to increase into consultatory solutions can also transform to Thomson Reuters Technique Onward. This market-proven method uses content, devices, and advice for companies curious about advising servicesWhile the changes have opened a number of growth possibilities, they have actually also led to difficulties and concerns that today's firms need to have on their radars. While there's variation from firm-to-firm, there is a string of common difficulties and problems that have a tendency to run sector wide. These consist of, but are not restricted to: To remain competitive in today's ever-changing regulative environment, firms must have the capability to promptly and successfully conduct tax study and improve tax reporting efficiencies.

On top of that, the brand-new disclosures might bring about a boost in non-GAAP actions, traditionally a matter that is extremely looked at by the SEC." Accountants have a great deal on their plate from governing modifications, to reimagined business models, to a rise in customer expectations. Keeping pace with all of it can be challenging, yet it does not need to be.

All about Summitpath Llp

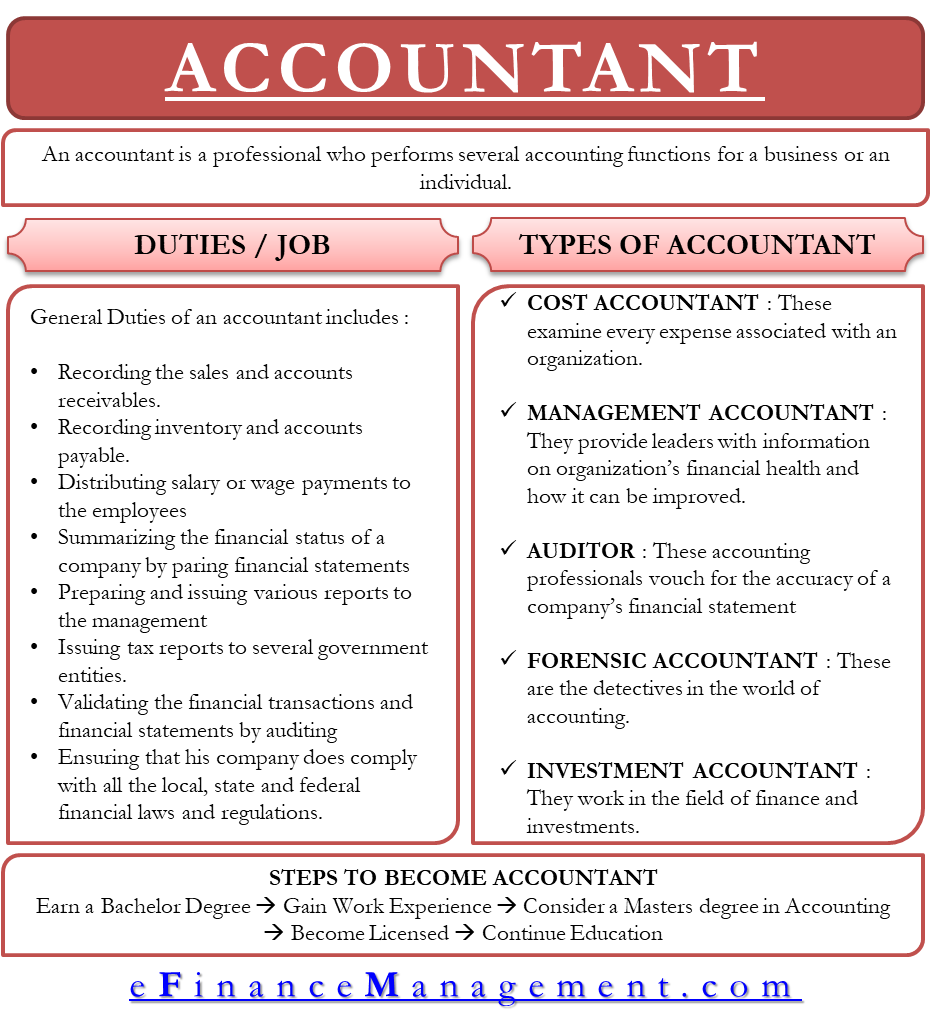

Below, we explain four certified public accountant specialties: tax, monitoring accountancy, monetary reporting, and forensic accountancy. CPAs concentrating on taxation help their customers prepare and submit tax returns, decrease their tax obligation burden, and stay clear of making mistakes that could result in costly charges. All Certified public accountants require some understanding of tax obligation law, but specializing in tax implies this will certainly be the emphasis of your job.

Forensic accounting professionals normally begin as basic accounting professionals and relocate into forensic audit functions with time. They require solid analytical, investigatory, service, and technical accountancy skills. CPAs who concentrate on forensic accounting can sometimes go up right into administration accountancy. CPAs need at the very least a bachelor's degree in audit or a similar area, and they should complete 150 credit score hours, including bookkeeping and service courses.

No states call for a graduate level in audit. An audit master's degree can aid pupils fulfill the CPA education requirement of 150 credits because the majority of bachelor's programs only need 120 credit scores. Accounting coursework covers subjects like money - https://free-weblink.com/SummitPath-LLP_244144.html, auditing, and tax. Since October 2024, Payscale records that the typical annual income for a CPA is $79,080. Calgary CPA firm.

Bookkeeping also makes sensible feeling to me; it's not simply theoretical. The Certified public accountant is an essential credential to me, and I still obtain proceeding education credit scores every year to keep up with our state needs.

What Does Summitpath Llp Mean?

As a freelance professional, I still utilize all the standard building blocks of bookkeeping that I discovered in university, pursuing my certified public accountant, and working in public bookkeeping. Among the important things I actually like regarding accounting is that there are various jobs readily available. I chose that I desired to begin my career in public audit in order to learn a great deal in a short amount of time and be revealed to different types of customers and various locations of bookkeeping.

"There are some offices that do not wish to think about a person for a bookkeeping function that is not a CPA." Jeanie Gorlovsky-Schepp, next CERTIFIED PUBLIC ACCOUNTANT A CPA is a really useful credential, and I intended to position myself well in the industry for different jobs - tax planning. I chose in college as an audit major that I desired to try to obtain my CPA as quickly as I could

I've fulfilled plenty of wonderful accounting professionals that don't have a CPA, but in my experience, having the credential really assists to promote your proficiency and makes a difference in your compensation and profession options. There are some work environments that don't want to consider somebody for a bookkeeping function that is not a CPA.

A Biased View of Summitpath Llp

I really took pleasure in functioning on different kinds of jobs with various clients. I discovered a lot from each of my coworkers and customers. I worked with various not-for-profit companies and discovered that I have a passion for mission-driven organizations. In 2021, I chose to take the following action in my audit occupation journey, and I am currently a self-employed accountancy specialist and organization consultant.

It continues to be a growth area for me. One important top quality in being an effective CPA is genuinely appreciating your customers and their services. I like working with not-for-profit clients for that very reason I really feel like I'm really adding to their goal by helping them have good monetary info on which to make clever business choices.

Report this page